Thrives, in fact.

The Merger Verger was looking for his Baked Alaska recipe the other day – in a fruitless attempt to impress a third-date woman friend – and what should drop out of the file labeled “recipes” but an article on Disney’s 2008 acquisition of Pixar. What ho, Malvolio!

So, we provide below a few nuggets from The New York Times piece entitled, “Disney and Pixar: the Power of the Prenup.”

The worries were two-fold: that either Disney would trample Pixar’s esprit de corps … or that Pixar animators would act like spoiled brats and rebuke their new owner.

The Verger says: Respect is a two-way street. Trust is a two-way street. But in both cases someone has to go first. Disney went first and that was the key to getting the deal right: they respected the unique culture and needs of Pixar and made that respect clear in words AND in ink. It makes perfect sense to expect the acquirer to go first. (Side note: that is one of the reasons why “mergers of equals” tend to fail; neither side wants to bend first.)

[Robert A. Iger, the new chief executive at Disney] … won some early support at Pixar by talking candidly and clearly about the [unpleasant] lessons he learned when his previous employer, the ABC television network, endured two takeovers.

The Verger notes: As the leader of the buyer, Mr. Iger knew that he had to convince the unconvinced. He used candor and p ersonal experience and he did NOT sugar coat it. If your target’s people are smart enough to do something that you want to have, then the chances are good that they’re also smart enough to see through sugar coating.

ersonal experience and he did NOT sugar coat it. If your target’s people are smart enough to do something that you want to have, then the chances are good that they’re also smart enough to see through sugar coating.

Don’t do it.

Mr. Iger also agreed to an explicit list of guidelines for protecting Pixar’s creative culture. For instance, Pixar employees were able to keep their relatively plentiful health benefits and were not forced to sign employment contracts. [He] even stipulated that the sign on Pixar’s front gate would remain unchanged.

The Verger notes: While the extent Disney went to may be over the top for industrial companies, for creative companies and service businesses it may not be. Keeping good people is in the details: health plans and signage; Disney even let the Pixar folks keep email addresses with the Pixar name rather than converting them to Disney.com. It’s the little things that evidence to people that you will do right when the big things arise. And this: Iger made a written contract about what he was going to do and not do; but he didn’t make his “new underlings” do the same.

And finally:

The key to successful integration, analysts say, has been Mr. Iger’s decision to give incoming talent additional duties. … “If you are acquiring expertise,” he told The Times, “then dispatch your newly purchased experts into other parts of the company and let them stretch their legs.”

The Verger notes: how better to let your new people know that you value their wisdom and their creativity than to put it to use on a bigger stage?

Obviously there’s some risk of professional dilution in letting people loose on too many projects, but giving acquired staff an opportunity to soar right when they are at their most worried can go a long way towards ensuring that your best talent doesn’t suddenly become your competition’s best talent.

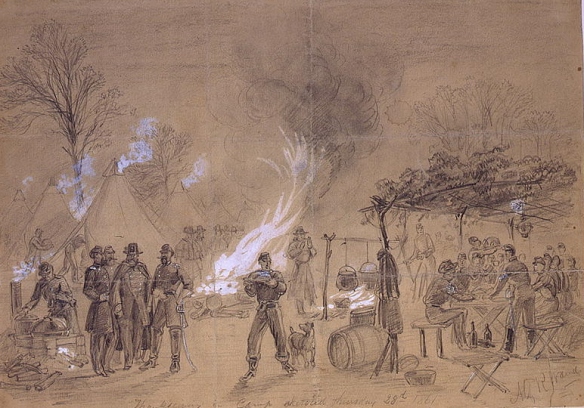

About the art:

Top: Finding Nemo, courtesy of Disney

Middle: DK (who cares?)

Bottom: Elena D’Amario of Parsons Dance Company (photo by Lois Greenfield)

should be the basis for a new deal. Not necessarily so, says the professor. Why? “Because each of us has a tendency to over-generalize from small sample sizes.”

should be the basis for a new deal. Not necessarily so, says the professor. Why? “Because each of us has a tendency to over-generalize from small sample sizes.”

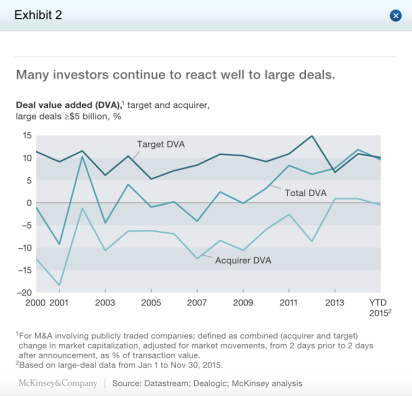

continued to be neutral on large deals (as regards the buyer’s shares), which is a step up from years past when they were decidedly negative.

continued to be neutral on large deals (as regards the buyer’s shares), which is a step up from years past when they were decidedly negative.

Short answer: no … but there are keys to the process. Interestingly, having answered “no” to his own question, Williams turns immediately to the importance of strategic logic. Let the

Short answer: no … but there are keys to the process. Interestingly, having answered “no” to his own question, Williams turns immediately to the importance of strategic logic. Let the

Leadership Forum, Sher sets the stage by asking this simple question:

Leadership Forum, Sher sets the stage by asking this simple question: